March is Women’s History Month and I wanted to use the occasion to focus on women in venture capital (VC) and their impact on investments in women led companies and women’s health. Unfortunately, women are missing from the public archives and the narrative of the VC story. I don’t know if the history of women VCs was unrecorded or lost. Fairchild Semiconductor was the first ever venture investment and their backers were the Rockefeller Brothers Fund (RBF), now Venrock. RBF was led by the five sons and one daughter (Abigail) of John D. Rockefeller Jr.

Is Abigail “Babs” Rockefeller Mauzé (not to be confused with her mother, Abigail Greene “Abby” Aldrich Rockefeller) the first female venture capitalist? I can’t say this for certain because, again, very little research is available. But what I do know is that the lack of women in this sector leads to a lack of women biotech entrepreneurs being funded. If we don’t take drastic measures to address these issues, things will remain stagnant. It will take bold leadership to right these wrongs. I can’t help but wonder what we are leaving on the table and what is not being considered for funding because of the current environment.

There are several efforts underway to increase the number of female VC’s as well as the amount of investment into women founded companies. Venture capitalists are risk-takers, innovators and disruptors however, this is not reflective in taking chances on women.

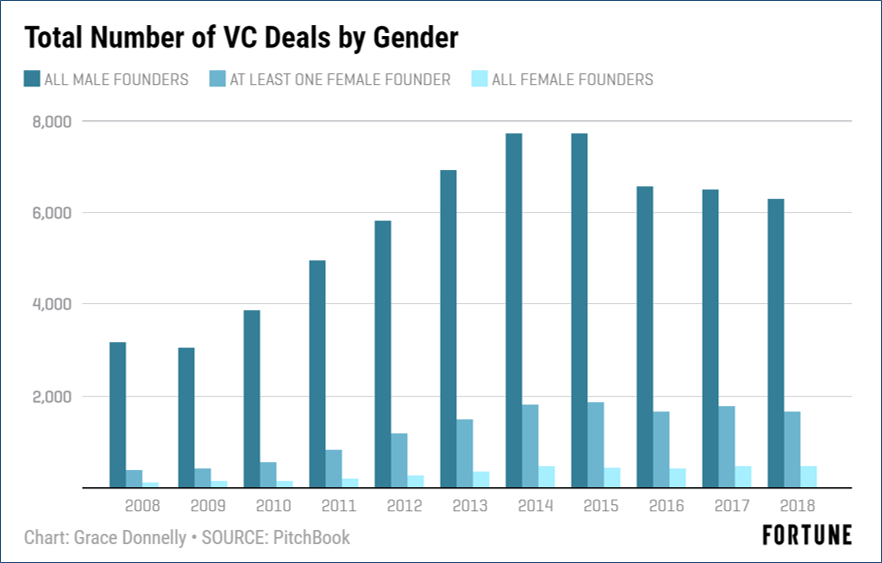

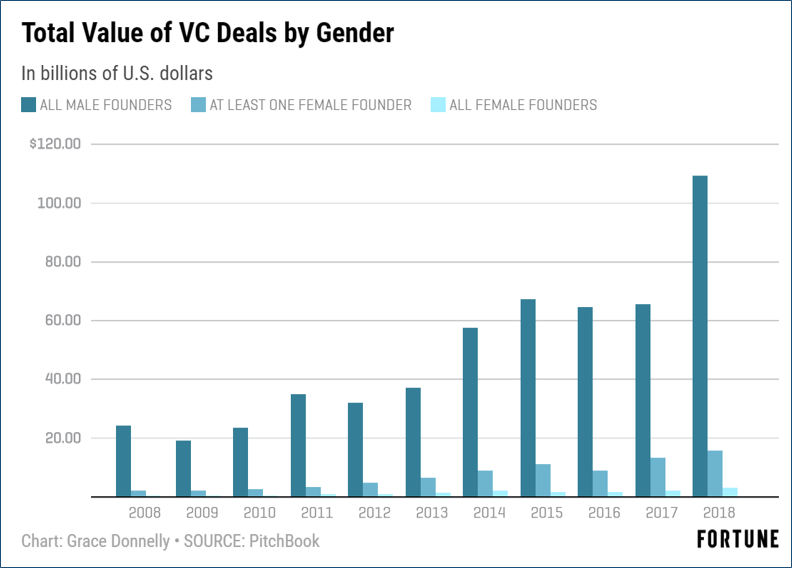

Despite efforts to level the playing field, U.S. female led startups have raised just 2.2% of VC investment across all industries. According to digitalundivided, an organization that leads high potential Black and Latinx women founders through the startup pipeline:

- Almost 90% of VCs are white males

- Only 3% of VC-backed CEOs are women

- Only 15.8% have at least one female founder

- African American women receive only 0.2% of all VC investment

- Latinx female founders received only 0.4%

Moving Forward

VCs take on the critical role of providing high risk investments to support biotech start-ups at every stage of development. But are they ignoring or resisting investing in women led companies and thereby ignoring groundbreaking discoveries that could provide solutions to unmet medical needs?

I spoke with Luba Greenwood, MassBio Board Member, and Head of Strategic Business Development & Corporate Ventures at Verily, an Alphabet company. I reached out to Luba because her career has spanned leadership roles in biotech and venture investing.

How can the VC industry accelerate more women in partner positions as well as more investments in female led companies? Investment, moreover, higher valuations in female led companies will come only once there are more women in senior positions. More women should also be brought in to venture firms as IRs, which will again open doors for women-led companies.

How can the VC industry accelerate more women in partner positions as well as more investments in female led companies? Investment, moreover, higher valuations in female led companies will come only once there are more women in senior positions. More women should also be brought in to venture firms as IRs, which will again open doors for women-led companies.

Why do you think it is important to invest in women founders? There is a lot of research that shows that women led companies and women investors generate higher ROI.

Less than 10% of all venture capital deals for biotech go to women, People of Color, and LGBT founders. Do you see this as an opportunity? This is not a pipeline problem. There are a lot of brilliant women, people of color, and LGBT researches and physicians that have no mentors, those who would help translate their work into an investment opportunity. We need to improve mentorship and more diversity at the Board level, both will help drive these opportunities.

A couple of high-schoolers doing work study at MassBio this spring have the following questions: If we had a class on the ‘History of Women in Venture Capital’, who and what should we be learning about? In the same vein as introducing STEM early, should we also be introducing the VC world? Sadly, there are few historic examples of women in venture. We are making history today in elevating women. In the future, students will look at women in the last fifteen years as the ones opening the door for others. Venture often incorporates two skills, a strong finance background as well as technical expertise, which can include clinical, scientific, technical, and legal. So, it would be beneficial to introduce STEM and finance early on, which could lead to venture and other forms of investing.

Do you think having women on both sides (VC / start-up) will improve advocacy for more research in women’s health? And, if so, what areas of research should we be focusing that needs attention? What a great question. The combination of both would absolutely increase funding in women's health. And in areas that have not historically been funded widely, including fertility, pregnancy and delivery, menopause, and oncology related to women's health.

One major initiative should be considered. Think about this: VC funding is provided by Limited Partners (LPs), for example pension funds. More and more people are concerned about social impact as well as where their pensions are invested and are advocating that their investments and pensions are aligned with their values. What if the LPs stipulated as a condition of investment that VC firms worked towards achieving measurable D&I metrics in their investments? Would change come at a faster pace? It seems likely.

I want to hear from you. Share your thoughts on how we can accelerate VC opportunities for women and increase access to funding for female led biotech companies.